Lantrasoft helped its Insurance Customer improve the turnaround time on the Business Impact Requests by 2.5x times earlier

Customer Overview

Leading Online Insurance provider in the U.S. in a highly competitive market with huge customer base and very high volume of business transactions on a daily basis.

Business Requirement

- Improve turnaround time on the Data Quality – Production Impact Requests.

- Address ageing requests to provide timely services to several thousand policy holders and end-customers.

Challenges Faced

- Evolving business requirements on the Impact Request

- Availability of the Business Users for solution review and approval

- Cross-functional coordination

- Lack of domain knowledge to a certain extent

Our Approach and Best Practices to overcome the challenges

- Understand and document the DB Objects and Schema in the backend

- Arrive at a mapped view of the Schema to business rules/code logic

- Apply business rule/logic from the documentation for each Impact Request

- Onsite training followed by internal knowledge sharing sessions

- 8x5 Support -> 24x6 Support

- For enhanced interaction and coordination between the requesting and the servicing teams.

Production Impact Requests – Some sample scenarios

- Policy retention discounts

- Campaign benefits not applied

- Sales Agent Application – Data sync issues

- Batch Job failures

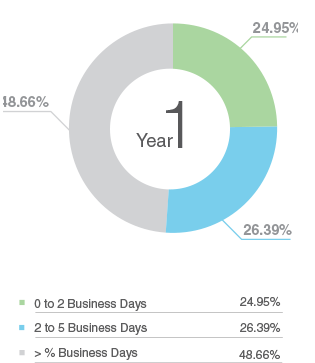

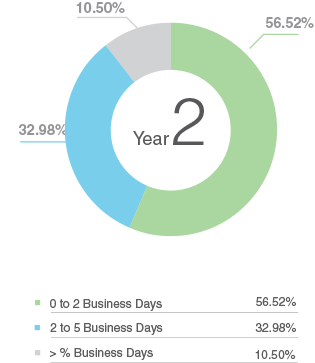

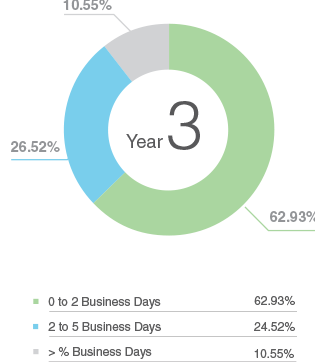

Results Achieved

- Less than 5 days closure TAT improved from 51% to ~ 90%

- Ageing requests beyond 5 days reduced from 49% to ~ 10%

- Dependencies for the 10% are –

- Availability of the Business Team

- Complexity of the Request

Results Achieved